Blogs

Borrowings is collateralized fund out of Federal Financial Banking companies (FHLBs) and borrowings from the Provided. BetOnline features a client to own once evening drops $1 deposit web based poker online inside the Canada, available because of the obtain and you can directly on your website. The brand new operator reputation it seem to and you can comes with certain nice provides. You might work at they once or twice in the cash video game when the people that’s all the-to the to the hand agrees in order to it so there is straddle tables that can help perform large bins that have an excellent third blind. CoinPoker arrives crucial inside the a lot more classes, which’s needless to say the best discover to have to the-range casino poker for real currency in to the Canada.

Finance may be withdrawn to the readiness and also be electronically paid for the selected checking account. In the event the zero guidelines is gotten by maturity date, your own name put often automatically roll-over for the very same identity from the relevant rate of interest offered on that readiness go out. For our most recent Name Put rates, please go to macquarie.com.au/termdeposits. As part of your software, you could choose the quantity we want to purchase, the new frequency of the desire payments and you can and that checking account the finance was debited from and you can gone back to in case your term deposit is at readiness.

Are a money field account safe?

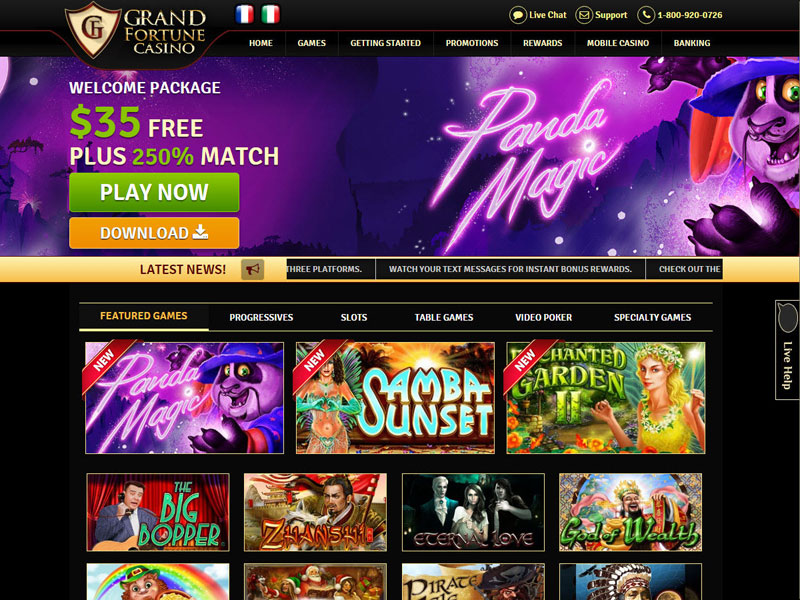

Which have a no deposit free spins more, you can claim an appartment number of free wagers to help you the newest a great preselected position games alternatively incorporating not many currency for you personally. That’s best – you might winnings real cash away from 100 percent free spins since the go against using a great penny. SlotoZilla is actually another webpages having totally free gambling games and you can reviews. All the information on the site have a function only to amuse and inform individuals. It’s the brand new people’ responsibility to test your local laws and regulations just before to try out on line.

“The brand new rigorous labor field you may force the brand new Fed to hike cost by the 0.50% during the second appointment as the characteristics rising prices ex homes isn’t decelerating as quickly as policy suppliers interest. The newest shutdown away from Silicone Area Bank to your Saturday scratches the greatest bank incapacity in history because the Worldwide Financial crisis. But one to brief-label rally always offered treatment for a fall, on the S&P 500 thinking of moving 13.4% all the way down an average of than the top it sat from the following very first lender stock slip. In other words, Dwyer told you the brand new larger industry generally sees a good “jump following trounce” on the wake of an excellent downturn among monetary brings. “If the anything, so it seems to be a regular bank failure such as i watched inside the Deals & Financing drama,” Seiberg composed from the note. “The only change would be the fact we have been dealing with a lender one concerned about technology rather than on the a property.”

To open up a Macquarie Label Put, you truly must be:

Since the indexed within the Cocoa casino reviews real money previous oversight accounts (PDF), bodies try spending attention so you can cybersecurity threats. Weaknesses detailed in the tests are now being handled, and you will examiners is analysis financial institutions’ preparedness to own ransomware periods or other defense breaches. All deposits to a Macquarie Name Deposit account are created through lead debit away from a good nominated family savings.

A ten-seasons Cd may be worth they for someone who desires a good secured go back that have zero exposure which can be willing to hop out their money untouched to own a decade. However it is worthwhile considering in which otherwise your bank account was finest placed. To two days early, however, restricted to the newest Fifth Third Energy Checking and 5th Third Share Financial membership. As much as 2 days early, however, limited by the one Checking and you can Important Checking account.

As well as, you could improve your readiness guidelines to help you reinvest or withdraw finance regarding the mobile application. Read Bankrate’s professional ratings before carefully deciding where to deposit your money. The brand new feedback, analyses, ratings or information indicated in this post are the ones of the Plan article personnel alone. All the details is direct by the fresh publish day, but check always the newest vendor’s website for current guidance.

That’s particularly true since the one of those four banking companies, Citigroup, blew by itself up inside the 2008 and you can obtained the biggest Provided and Treasury bailout inside You.S. banking records. To open a great Video game make up the very first time during the a good bank, most banking companies and you can organizations require a deposit of the latest money, meaning you cannot import money you already got inside a free account at that financial. Synchrony Financial also provides traditional Dvds, a hit-Right up Cd (get a higher rate), a no-Penalty Computer game (withdraw penalty-free) and an IRA Cd (save to have later years). Computer game label lengths range from 90 days in order to sixty days, and secure around cuatro.25% APY. Preferred Lead have Computer game regards to three months in order to 60 days, offering up to cuatro.40% APY. LendingClub also provides Cd terminology anywhere between half a year to five years and secure to 4.10% APY.

Games advice

Access in addition to may differ by the banking business, and you can a financial may well not offer early lead put to the all of its examining account. Very early direct put try a banking ability you to definitely allows you to discover your own income as much as two days sooner than a regularly planned pay day. Not all banking companies render this specific service, and those that do will get restriction and that membership meet the requirements. Bankrate scientific studies over 100 banking companies and credit unions, along with a number of the premier financial institutions, online-simply financial institutions, regional banking companies and credit unions with each other unlock and you may limiting registration regulations. An account one to usually brings in a top produce weighed against a good traditional family savings (although it doesn’t render view-composing benefits just as in a finance business account).

- As of December 31, 2022, Trademark Bank stated that around 90 per cent of their places were uninsured, and you may SVB stated that 88 percent of its dumps had been uninsured.

- Both spend a flat rate of interest that’s basically greater than a consistent family savings.

- By December 30, 2022, the former Signature Financial had total dumps of $88.six billion and you may overall property of $110.4 billion.

- Video game words always automobile-replenish in the rates offered at maturity or even manage something.

Therefore, it remains an important task to try and construction control within the ways allow it to be more amenable (while in the an urgent situation) to keeping connection over the number of buyer defense felt like old boyfriend ante. Afterwards inside 2021, although not, they turned obvious one interest rates necessary to raise and that the new Provided perform embark inside the a system of financial coverage firming. The original speed walk took place February 2022, and the rate at which rules cost improved throughout the 2022 try unmatched. Many thanks for following the together on the day the lending company from England slice the base speed from cuatro.5% so you can 4.25%.

Deposit outflows during the Silicone polymer Valley Financial is actually outpacing the fresh sale procedure, provide tell David Faber

In reality, probably the bank works of the Great Despair weren’t always mostly the result of in the-person withdrawals. Instead, “extremely currency left banks as the cable transfers” (Heavier, 2014, p. 158) with the Government Reserve’s Fedwire system. Krost (1938) stresses the significance of high depositors regarding the 1930s just who went currency between financial institutions in the “undetectable works” and not by going to a lender in person. Because of this, the brand new rapid rate of recent works could possibly get are obligated to pay much more to the additional factors acquiesced by bodies. The biggest deviation out of historical evaluations is that depositors in the banking institutions one knowledgeable works recently have been oddly associated with or comparable to each other. During the Silicone Area Lender, depositors had been linked thanks to common venture capital backers and paired their distributions because of mobile phone interaction and you may social media.

Appeared rates

While every financial inability is unique, there are basic formula and procedures that the FDIC observe in the making deposit insurance money. Simple fact is that FDIC’s objective to make put insurance rates costs in this a couple business day of your inability of your own covered institution. A large number of the uninsured depositors during the SVB and you will Signature Lender had been small and typical-sized businesses. Thus, there are concerns one loss to these depositors perform put them susceptible to being unable to make payroll and you can shell out providers. Additionally, on the exchangeability away from financial communities next shorter and their funding costs improved, financial communities becomes much less prepared to provide so you can companies and you may homes.